Month: September 2025

Top Forex Currency Pairs for Profitable Trading in 2025

The Fragile Reality of Fix-and-Flip Homes: Why the Market May Be on the Edge

Rent Reporting in 2025: Unlocking Credit Potential or Risking Your Financial Future?

The Mirage of Low Mortgage Rates: Why Homebuyers Should Stay Cautious

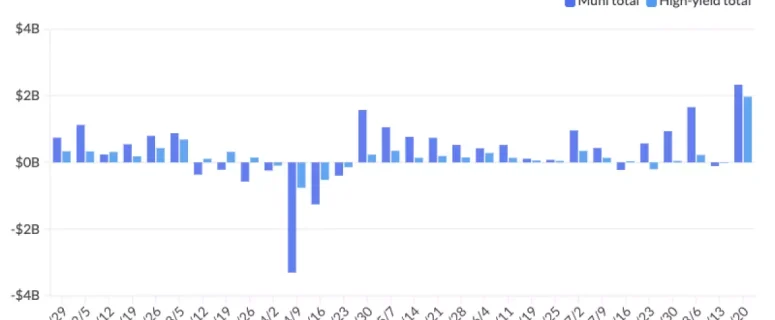

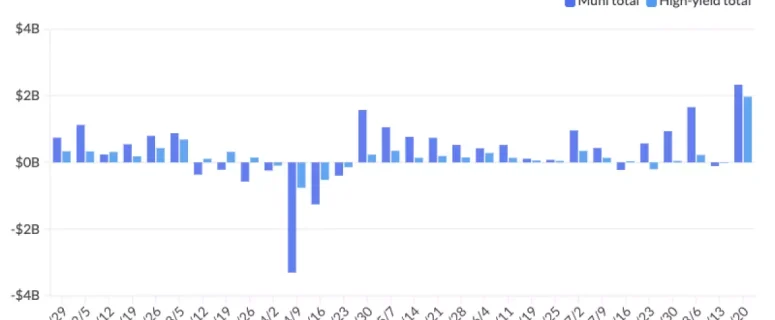

Refinance Frenzy Sparks Unease: How Low Rates Are Masking Economic Risks

McDonald’s Financial Success: Questioning the Sustainability of Short-Term Gains

Beyond Hawkins: Why the Duffer Brothers’ Paramount Deal Could Reshape Hollywood

The Velvet Rope at 30,000 Feet: Are Airlines Sacrificing Accessibility for Elite Profits?

Hertz’s Digital Crossroads: Is Selling Cars on Amazon a Masterstroke or a Misstep?

Ad Blocker Detected

Our website is made possible by displaying online advertisements to our visitors. Please consider supporting us by disabling your ad blocker.