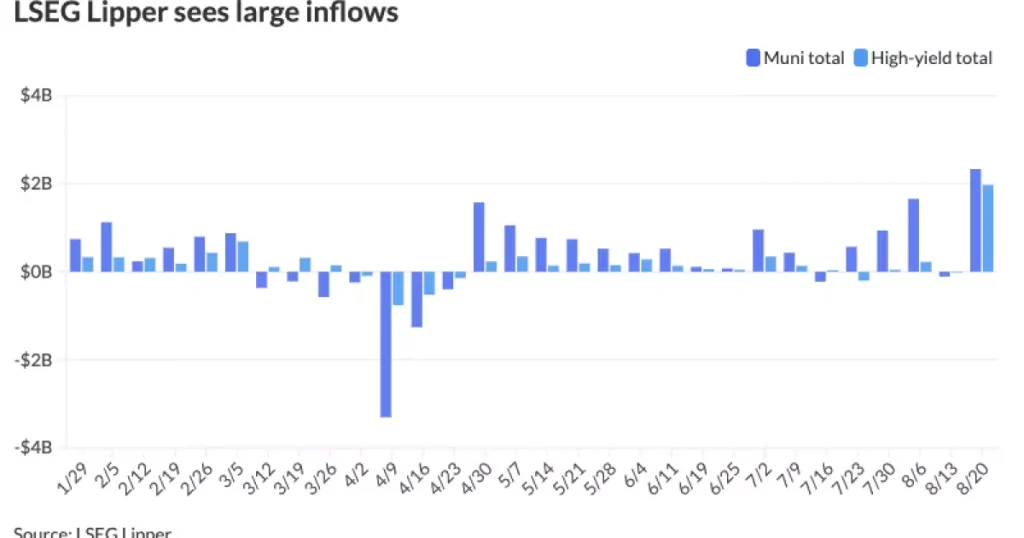

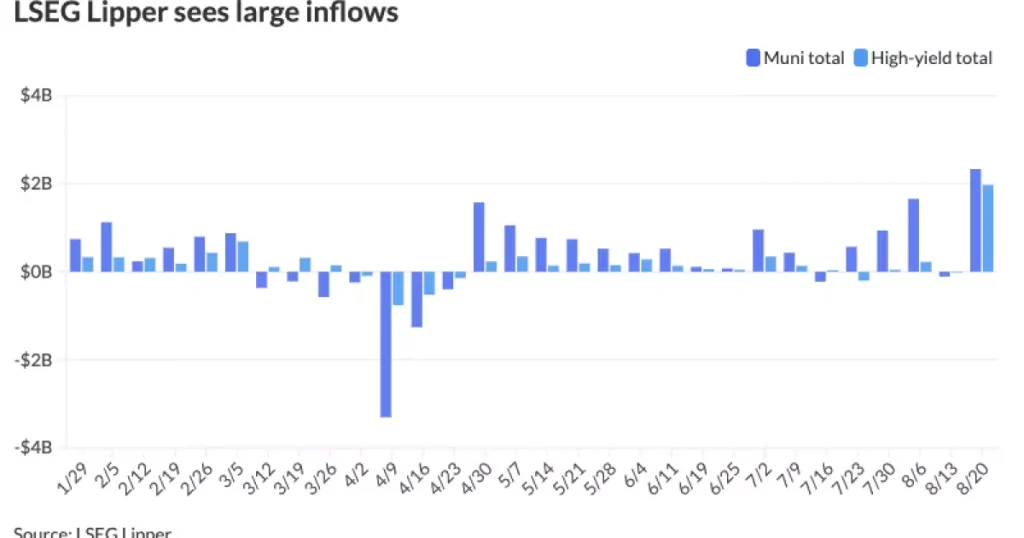

Recent weeks have painted an overly optimistic picture of the municipal bond market. A notable surge of over \$2.3 billion into municipal bond mutual funds in a single week suggests renewed investor confidence. Yet, beneath this seemingly bullish facade lies a market whose fundamentals remain fragile. Much of this influx is concentrated in high-yield ETFs and short-term reallocation strategies, reflecting tactical maneuvering rather than genuine credit strength. While inflows provide liquidity, they mask deeper vulnerabilities that could amplify losses if conditions shift.

Technical Gains vs. Fundamental Weaknesses

The municipal market has benefited from technical factors such as a subdued primary issuance calendar and steady trade volumes. However, these elements serve more as temporary support than indicators of lasting resilience. Large inflows are dominated by a handful of ETFs, particularly those targeting high-yield municipal debt, suggesting a speculative environment. When investor behavior is guided more by short-term momentum than by credit quality, the market risks inflating a bubble that could collapse once liquidity-driven enthusiasm wanes.

Technical indicators like the muni-UST ratio—currently showing 2-year at 59%, 10-year at 75%, and 30-year near 95%—might appear neutral or slightly favorable to munis. Yet these ratios largely reflect supply-demand dynamics and market liquidity rather than true fiscal health. Similarly, stable trade volumes could indicate hesitation rather than strength, revealing a market reliant on momentum rather than fundamentals.

Liquidity Strains and Rising Vulnerabilities

Municipal money market balances have declined to levels last seen in mid-April, signaling a shrinking liquidity buffer. As investors grow cautious amid potential rate hikes and thin margins, the market becomes increasingly susceptible to shocks. Yields on money-market instruments exceeding fixed coupon rates further highlight a precarious environment. Any sudden change in investor sentiment or interest rates could trigger rapid outflows, leaving municipal bond prices exposed.

Liquidity is also impacted by the concentration of high-yield funds. A large portion of inflows is funneled into a few select ETFs, creating the risk of overcrowding. Should these ETFs experience redemptions, the market could face cascading effects, forcing rapid liquidation of assets at depressed prices. This feedback loop emphasizes how speculative inflows can create instability rather than genuine market strength.

Macroeconomic and Political Risks

The broader economic and political landscape adds layers of uncertainty. Anticipated Federal Reserve actions, including potential rate cuts, are not guaranteed. The upcoming FOMC meeting could act as a catalyst for volatility, especially given September’s historical pattern of losses in fixed income markets.

State and local governments face pressures from inflation, labor shortages, and infrastructure deficits. Heavy reliance on borrowing for essential services increases fiscal vulnerability. Any federal policy shift toward austerity could tighten budgets, undermining municipal finances.

Investor behavior further magnifies these risks. The strong inflows into high-yield ETFs reflect herd-like activity—investors chasing returns in a low-growth environment. While high yields are attractive, they come with elevated credit risks. Defaults or downgrades in even a single sector can trigger contagion, rapidly reversing inflows and exposing structural weaknesses across the municipal market.

Historical Perspective and Market Cycles

History offers cautionary lessons. Municipal markets have experienced periods of optimism followed by sharp corrections. During the late 2000s, municipal defaults spiked in some states due to overleveraging and fiscal mismanagement, despite strong technical indicators suggesting stability. This historical precedent highlights that inflows and technical ratios alone cannot safeguard investors against systemic shocks.

Similarly, high-yield segments often outperform during low-interest-rate environments, but they are vulnerable to macroeconomic reversals. A sudden spike in rates or a decline in tax revenues can disproportionately affect these instruments. Retail investors, drawn by headline returns, may underestimate the depth of these risks, making them susceptible to rapid losses during corrections.

Strategic Considerations for Investors

Given the fragile fundamentals, investors must adopt a cautious, disciplined approach:

- Diversification – Avoid overexposure to high-yield ETFs or concentrated municipal sectors.

- Credit Analysis – Evaluate underlying municipal issuers, focusing on fiscal health and debt obligations.

- Liquidity Management – Maintain adequate cash buffers to withstand potential market drawdowns.

- Macro Awareness – Monitor Federal Reserve actions, inflation trends, and regional fiscal policies.

- Redemption Preparedness – Anticipate potential ETF outflows and their market impact.

By integrating these strategies, investors can mitigate risk while still participating in the municipal bond market.

Conclusion

The apparent stability in the municipal market is largely cosmetic. Growth is propped up by technical factors such as favorable CUSIP activity and steady yields, rather than genuine economic improvement. Without structural support—like healthier municipal finances, diversified credit exposures, and improved tax bases—the market remains vulnerable to shocks. Current inflows may represent the peak of a speculative cycle rather than the beginning of a sustainable recovery.

Investors should approach the municipal market with skepticism, prioritizing careful credit analysis, risk management, and awareness of macroeconomic trends. While high yields are alluring, the potential for rapid reversals and systemic stress underscores the hidden fragility of today’s municipal bond environment. Understanding both technical signals and underlying fundamentals is essential for navigating these complex and volatile markets safely.